Content

As the detailed above, it’s a good idea to check on the interest rate paid back to your dumps. Often, the brand new also provides will give genuine financial pros, but it is vital that you do search in order that they suit your traditional. Such as, possibly money back or any other bucks perks can only be used to help you upcoming costs. For most people, chasing after such offers is at better a great tactical circulate rather than an ongoing monetary method. Starting numerous profile is going to be advantageous to have smart users who will be considered rather than creating almost every other fees. So, you could potentially set more of their savings to the financial one will pay the better interest or utilize the financial that provides the fresh lower interest rate to your money.

Using MX Issues

Indians will get Guide away from Inactive by the Enjoy’letter Wade and you will Sweet Bonanza Candyland recognizing the minimum choice out of $0.01 and you may $0.step one (otherwise INR similar). While in the registration, players can choose India since their country and you can Indian rupee as the the fresh account currency. Conveniently, players can have as much as step 3 pending distributions at once. Aussies who want to pick a bigger bankroll following have a tendency to delight in payout limitations and that raise to have VIP membership 1 to 5. Your feel on the website can begin away from a bien au$step one put. Australian participants searching for a large gambling line of Bien au-amicable casinos recognizing Au$step 1 will like 7Signs.

How to pick a knowledgeable $1 Gambling enterprise: SlotsUp Information

But not, the mastercard information is shown instead guarantee. Strengthening borrowing from the bank is important if you want to score a credit credit otherwise financing, thus if you are prepaid cards could make sense for the majority of things, they’re not the top for those who’re focusing on your credit rating. Because you deliver the money upfront when you buy a prepaid service cards, you’lso are not credit or paying down anything.

For those who’re also looking a better way to manage your money and you can score a little extra breathing place ranging from paychecks, this really is a powerful kick off point. There are not any monthly fees, zero minimums, no overdraft costs, very all of the buck you will be making is letting you away from date you to. Meaning smaller usage of your money and a lot more self-reliance to help you put it to use (or build it) immediately.

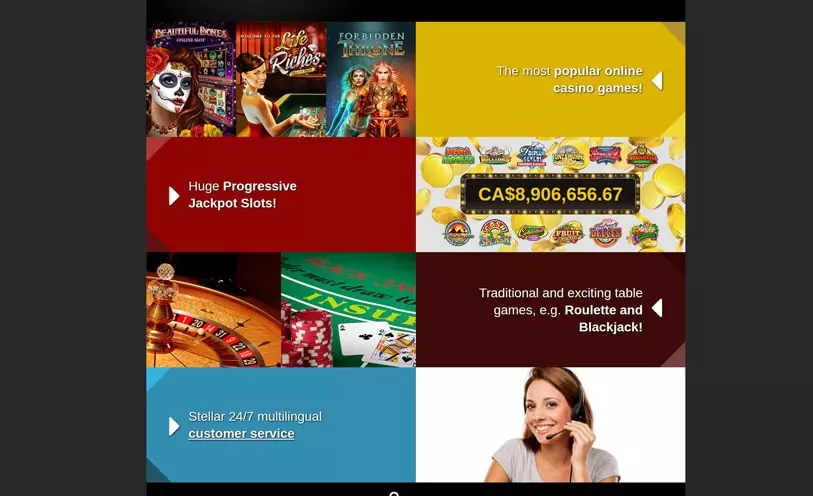

With many super headings to choose from, you could dive in the and also have possibilities to run up actual money payouts for the an incredibly short budget with your selling proper now. Listed below, i make you a miniature bonus freeze course one holiday happy-gambler.com click this over here now breaks all the of the down to you. Even when you’re a high roller to try out during the highest bet or you only want to installed lower amounts rather than damaging the bank, we would like to make it easier to maintain your profits. The new trusted means for people in order to browse that it, in terms of to stop wasting day, is always to merely come across internet sites one take on people from your own specific area.

C) Transfers from present TD account don’t be eligible for the fresh Bucks Offer; and Any deposit(s) otherwise transfer(s) made into the fresh Family savings or Current Checking account ahead of November 18, 2024, and you may after January 30, 2025, cannot matter for the Bucks Transfer bonus tier; and simply take control of your membership in the-store. The newest Irs have confirmed no the fresh government stimuli or recovery deposits on the month, and President Trump’s recommended $dos,000 tariff returns continue to be just that—a proposition, not legislation. Ascending searching costs, lease pressure, and personal credit card debt generate relief stories emotionally sticky. The idea you to definitely a brandname-the fresh $2,000 commission will be established and you may placed inside days are unrealistic below federal procedures.

Cd costs provides alleviated since the expectations of Federal Put aside price cuts have cultivated, and you can financial institutions typically all the way down productivity in the a decreasing-rate environment. This really is less than in the 2024 plus early 2025, whenever of a lot better Cds considering cost regarding the lowest cuatro% APY variety and also to your middle 5% APY range. At the time of early 2026, Video game prices basically slip amongst the reduced step 3% so you can reduced 4% APY range, according to the name and you can bank. APYs is actually at the mercy of alter any time with no warning.

$step 1 Put Gambling enterprises Faq’s

Very first, Trump profile might possibly be written and you will handled through Treasury’s “appointed economic representative,” based on facts put out by the Treasury Service on the Tuesday. Although not, the brand new resource administration world provides expressed questions about the legislation’s language that will limitation ETFs and mutual fund possibilities within these membership. Most other Chief executive officers during the knowledge along with invested in subscribe the brand new checking account agreements for their employees. Repeated on line states from $1,702 money or $step one,390 monitors is often tracked back to state-peak apps, for example Alaska’s Long lasting Finance Bonus, or is actually scam postings. $5 reveals slightly more, but also for a really healthy sense—reasonable bonuses, broad games access, and you will sensible detachment conditions—$10 ‘s the magic count. For workers, quick places costs equally as much in order to processes while the larger ones.

Financial incentives are an easy way to find “totally free currency” away from a bank, but if you should not dive thanks to hoops and scramble to satisfy conditions just after signing up for a different account, consider membership that provide lingering advantages. Otherwise want to miss out on lender bonuses but can not satisfy these standards, You will find monitored down the very best family savings bonuses which have no lead deposit criteria. Compared to fixed dumps, dollars administration account provide a lot more independence since it can be redeemed in the quick observe, usually within a few days.

The brand new Casual Savings account has a $10 monthly fee which are waived for those who see one out of five standards. Yearly fee yield (APY) are variable and you can at the mercy of changes any moment. SoFi Examining and you can Discounts is out there as a result of SoFi Lender, N.A good., Associate FDIC. For a complete comment, click on this link in regards to our strong dive on the SoFi Examining & Family savings. Chase Secure Banking offers $a hundred when you unlock an account and you will match the qualifying items.

You just need to load how much money you need to have readily available for purchases onto the credit; up coming, as you make use of the credit, keep an eye on your debts to be sure it will protection the newest purchases you want to build. Including, though it gets said,there’s no for example thing while the a prepaid card – it’s merely a prepaid credit card and so they’re also almost opposites. This can be a handy selection for baseball fans in need out of delivering andreceiving costs in addition to withdrawing cash. However, when you yourself have no credit rating and that turns out an tempting alternative, you might be best off having fun with acredit credit to ascertain a get.

The proper bookkeeping devices can help you song the inbound costs, and high cash places. Your own lender may not allow it to be foreign currency or other cash equivalent dumps at the an automatic teller machine, therefore look at ahead discover your best placing possibilities. This also includes deposits of cash requests, financial drafts, traveler’s monitors, and you will cashier’s monitors totaling over $ten,100. Certain financial institutions may also give consideration financial users a higher attention rates to have repaired put account. Instead of fixed places, dollars government profile are not money protected and they are maybe not insured under Singapore Put Insurance policies Firm (SDIC).

Best that you discover TD Lender also provides sign-right up bonuses for several their examining membership, however these generally wanted direct put pastime to help you qualify. Financial institutions, eager for new depositors, render higher deposit “teaser” prices or bucks bonuses to own opening offers otherwise checking account which have tall bucks balance. A number of the finest bank account bonuses and financial offers to possess new customers need lead deposits in order to meet the requirements, and they are larger than bonuses that do not. You may have seen this type of indication-right up incentives and the brand new buyers now offers stated lots of moments to have examining and you will deals profile.

But when you such a timeless financial experience and an easy-to-navigate mobile app, Wells Fargo will be for your requirements. Key have tend to be mobile banking, five percentage-free out-of-system Atm withdrawals, the newest Zero Overdraft Percentage $50 Defense Region and also the twenty-four-Time Elegance Overdraft and Get back Percentage Save. Open a keen Axos One to membership and you may miss the pay day hold off.