Content

Antique survivor pools where gamblers choose one people so you can winnings downright per week. TeamRankings.com try solely accountable for the site however, can make no make certain regarding the precision or completeness of the advice herein. You can even establish your survivor pool with loved ones otherwise subscribe someone else’s, with personalized laws and regulations such as making it possible for a certain number of affects.

Va Insurance Professionals for Pros within the 2025

Utilize this desk if perhaps you were ages 70½ after December 29, 2019, but had not reached decades 72 prior to January 1, 2023. Use this dining table for many who reach years 72 once December 31, 2022. In order to complete your tax get back, use the following the appendices that include worksheets and you may dining tables. TAS strives to protect taxpayer liberties and make certain the new Internal revenue service try applying the newest income tax law inside the a good and you will equitable means. Visit /Taxpayer-Liberties for more information concerning the rights, what they indicate for you, and exactly how they apply at specific things you can even encounter having the brand new Irs.

Handicapped Survivors

A health care provider need to dictate that your particular position to expect in order to cause death or perhaps to be away from a lot of time, went on, and you may indefinite stage. You simply will not have to pay the brand new taxation in these quantity if all of the following requirements pertain. You might just take into account unreimbursed scientific expenditures you could use in calculating a good deduction to have scientific expenses to the Plan A great (Form 1040).

Is my former companion continue medical health insurance visibility?

A surviving spouse can also be roll over the fresh shipping to a https://vogueplay.com/au/the-mummy/ different conventional IRA and get away from and they within the money on the 12 months gotten. The newest recipient is also subtract the fresh estate tax paid off for the one region of a distribution that’s money when it comes to a good decedent. A beneficiary can claim an excellent deduction to have home taxation through particular withdrawals out of a timeless IRA. Like the brand-new owner, you generally would not are obligated to pay income tax for the assets on the IRA if you do not discover withdrawals of it.

But to determine when it’s the right complement your family and you will include they to the your current monetary bundle, imagine talking-to a monetary mentor who’s knowledgeable about armed forces shell out and you will advantages. Getting qualified to receive the brand new SBP, a good retiree should be eligible to army retired pay, which means 20 years of solution. If your impairment gets far worse, you can file a state to own an increase in advantages. Savannah pointed so you can an eye fixed-to-attention having Sophie which they come together unlike up against for every other one to paid off when Sophie found Savannah to inform its trio one to Jawan and Sage were flipping on Uli. Soph discussed the woman family history as the immigrants, working because the she is actually an adolescent, as well as the sacrifice she generated deciding to be an entire-date caregiver to help you her grandma in which it fused over the let you know. It was Time twenty six of their own time inside Fiji when Sage, Soph, and you can Savannah reflected for the becoming the first the-females final around three in the 20 year and you may wishing the speeches to help you show the new jurors.

Is Experts Benefits Taxable?

For Experts who never acquired a DD214 but broke up which have a keen respectable discharge, you can use and establish you never ever obtained the paperwork. You can even sign up for an improvement for individuals who don’t ensure it is initially, even when following a somewhat various other strategy. While you are an experienced who had been discharged due to intellectual illnesses, army sexual injury (MST), or your own sexual orientation considering the Wear’t Ask, Don’t Give coverage, it’s probably your’ll found an update.

Come across Shipment: How many Rivals Tend to Favor So it Party?

HHS helps inside a career, wellness, psychological state, drug abuse, and you may boy and you may family services to have Experts. The newest HHS aims to increase the health and interests of all the Americans because of energetic health insurance and people services while you are advancing scientific, social fitness, and you may personal sciences. To learn more about the fresh opportunities you to definitely best suit you and the ones you love, contact the newest USDA from the sending a message in order to

IRA Beneficiaries

- There are choices for kid-simply visibility, or mate-and-kid coverage, and this involve additional calculations in accordance with the period of the brand new retiree, partner and kid.

- Ignore people recharacterized sum one to leads to an IRA most other than a great Roth IRA for the intended purpose of group (aggregating) each other contributions and you may distributions.

- Create or availableness your internet membership from the Irs.gov/Account.

- I work to ensure that all the taxpayer is addressed pretty and you can that you experienced and understand your own rights beneath the Taxpayer Statement from Liberties.

- For individuals who discover a distribution from the Roth IRA that isn’t a qualified distribution, element of it can be taxable.

For information, come across Handed down out of mate below Let’s say You Inherit an enthusiastic IRA, earlier in this chapter. For years after the 12 months of one’s customer’s dying, see Owner Passed away Just before Expected Delivery Day, later on, under IRA Beneficiaries. Withdrawals in of the owner’s death. Your annuity costs inside the 2025 complete 8,one hundred thousand. As of December 29, 2025, your own left account balance are 100,000, and the value of the new annuity offer are 200,one hundred thousand.

To have veterans attending have children later in daily life, they are able to initiate adding to the newest SBP quickly and you can become partner or son coverage when ready. Rather than a partner otherwise eligible centered to get the new annuity, it does feel like an unneeded costs. Whether or not SBP premium will get get rid of month-to-month senior years shell out, the new life annuity for survivors can be far meet or exceed the program’s initial costs.

Thriving partner is just appointed recipient. Should your beneficiary try over the age of the brand new deceased IRA proprietor, utilize the proprietor’s life span in away from demise (quicker from the 1 for each next season). In cases like this, use the proprietor’s life expectancy for their years by the proprietor’s birthday around from passing and relieve they because of the step 1 for every subsequent season. As an alternative, the new inactive beneficiary’s left interest must be marketed in this 10 years following the beneficiary’s demise, or even in some instances in this a decade following owner’s dying.

In addition to, you could pay off the new delivery and not end up being taxed to the distribution. Zero withdrawals was produced from her IRA. Withdrawals away from some other Roth IRA cannot be substituted for this type of withdrawals until additional Roth IRA are inherited from the same decedent. When the a great Roth IRA manager dies, minimal delivery regulations one to apply to antique IRAs apply at Roth IRAs like the brand new Roth IRA manager passed away just before the required birth go out. Yet not, following death of a Roth IRA manager, particular minimal delivery laws you to definitely affect old-fashioned IRAs and implement in order to Roth IRAs, while the said later less than Withdrawals Just after Owner’s Death. In the August 2025 he grabbed an excellent 85,five hundred early delivery out of their Roth IRA to make use of as the an excellent downpayment to the purchase of his first family.

Opinion Va DIC enduring mate and you can son cost for past many years. It’s managed from the Defense Finance and Bookkeeping Services (DFAS) at the Shelter Agency. Depending on its army solution, players can use this choice to buy a great Survivor Benefit Bundle (SBP) otherwise Set-aside Parts Survivor Work with Plan (RCSBP). You’re also an eligible boy for many who meet at the least one of the criteria listed below.

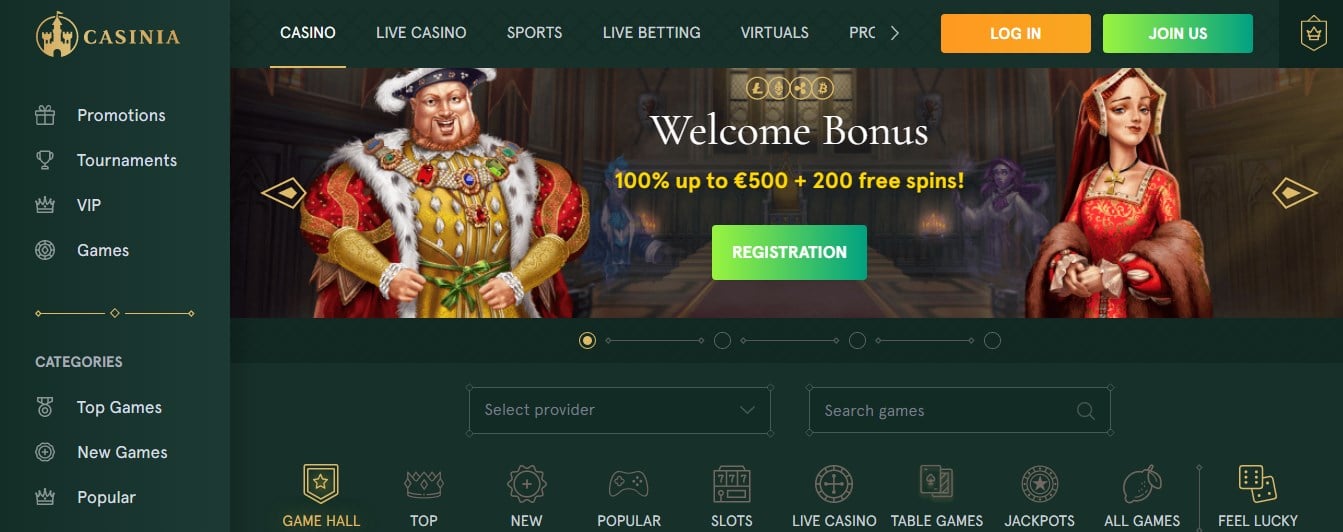

Usually, when we rating all your later years details, you can expect “interim” money. To make your account, complete one requested information, just like your name and you will email address. Including, when the a no deposit extra asks for a wager out of 60x or higher inside each week, you could find a lesser return with an increase of go out.